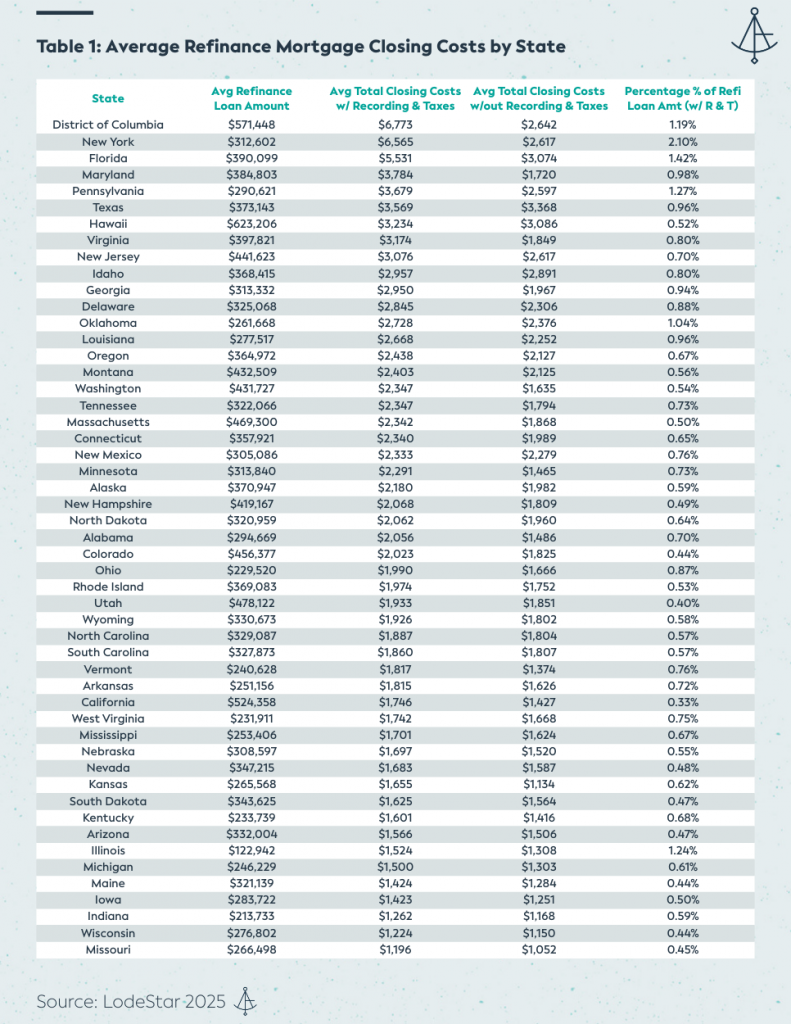

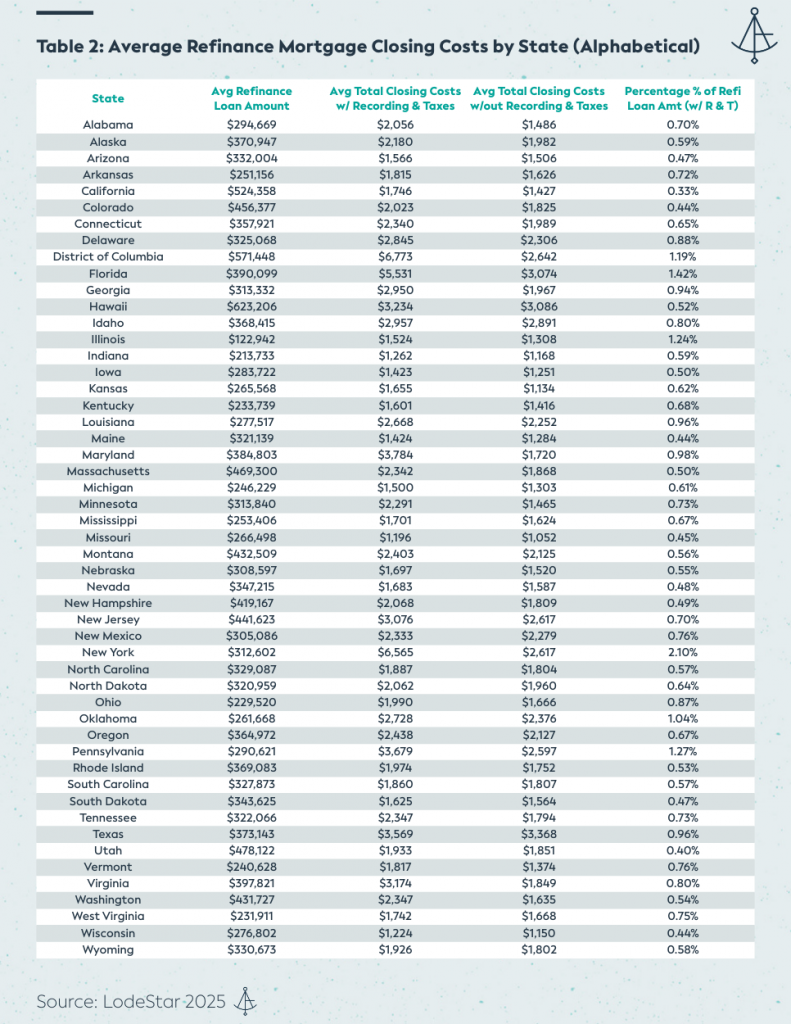

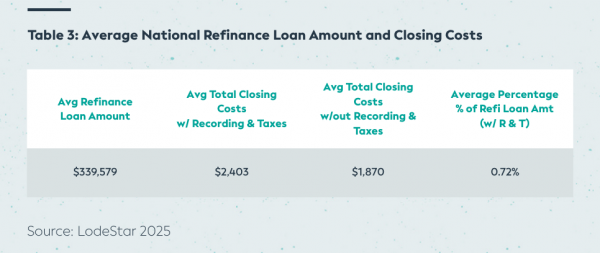

Conshohocken, Pa., May 5, 2025 – LodeStar Software Solutions, a leading provider of nationwide mortgage closing cost data, today released its first refinance mortgage closing cost data report, which showed that the national average total closing costs for a refinance mortgage transaction were $2,403. This amount consists of a national average of 0.72% of the home refinance loan amount.

Key Takeaways

- Closing costs as a percentage of refinance loan amount hovers around 0.3% to 2%, with an average percentage of 0.72% and a median of 0.65%. New York leads the pack with 2.1% of the refinance loan amount.

- The states without one of the following—mortgage tax, mortgage recordation tax, mortgage intangible tax, or mansion tax—tend to have a lower total closing cost when expressed as a percentage of the refinance loan amount.

- The states with the highest closing costs as a percentage of refinance loan amount tend to be in places where the above taxes make up the bulk of the overhead. DC, New York, Florida, Maryland, and Pennsylvania are great examples of this.

- The states with the lowest closing costs in comparison to the refinance loan amount were California (0.33%), Utah (0.40%), and Maine (0.44%).

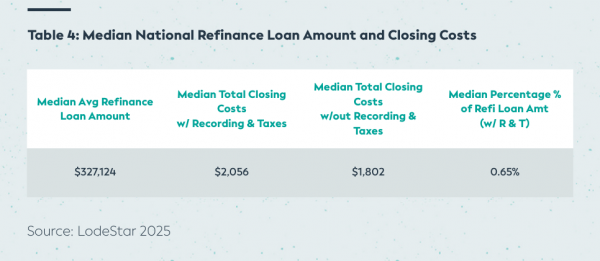

- The national average and median refinance loan amounts are $339,579 and $327,124, respectively.

- The national average and median total closing costs (w/ recording and taxes) are $2,403 and $2,056, respectively.

- The national average and median total closing costs (w/out recording and taxes) are $1,870 and $1,802, respectively.

“The effect of recordation taxes and fees on the total closing costs as a percentage of the refinance loan amount is notable,” said Ron Carvalho, Director of Data Operations at LodeStar. “Texas, which has no transfer taxes but holds the sixth highest total closing cost as a percentage of refinance loan amount, is an outlier. Virginia and New Jersey, which both have transfer taxes, hold eighth and ninth places, respectively.” Ron also notes that, “Hawaii, in seventh place, does have transfer tax, but that tax is seller paid and only on deeds. The amount in that state is surprisingly high in this case, since there are no mortgage taxes due for refinances.”

Source for all tables: LodeStar Software Solutions, 2025

Methodology

LodeStar defines average closing costs as the average fees, recordation charges, and transfer taxes required to close a typical refinance transaction in a geographical area, in addition to the following service types: settlement/closing/escrow fees, and title policies (both owners and lenders).

The actual closing fees from a sample of 92,000 refinance quotes, from January 1 through December 31, 2024, were analyzed. Loan amounts over $10 million were not considered.

LodeStar calculates the percentage of the refinance loan amount as the average total closing costs with recording fees & taxes included divided by the average refinance loan amount in a given geographical area.

About LodeStar

Mortgage closing costs are all LodeStar does. From statewide transfer taxes to granular township-level fees, LodeStar makes sure your closing costs are spot-on for every disclosure.

Above all else, LodeStar’s core values are providing CLARITY, COMMUNITY, and CONNECTIVITY throughout the mortgage industry.

With the arrival of TRID, co-founders Jim Paolino and David Spektor saw a need for specialists. Managing closing costs might seem like something simple and easy that you can handle in-house. But as many lenders have learned, the world of closing cost disclosure comes with tons of risk: expensive tolerance cures, frustrating LO errors, and the list goes on. LodeStar acts as your partner in fee management, so you can have one less thing to worry about along the road to close.

Media Contact Info

Tim Austen

Marketing Content Manager

tausten@lssoftwaresolutions.com

Contributors

Jim Mark, Quality Control Manager

Ron Carvalho, Director of Data Operations

Tim Austen, Marketing Content Manager

Alayna Gardner, Director of Revenue