The Power of Good, Useable Stats

The great Mark Twain once attributed the following famous remark to Benjamin Disraeli: “There are three kinds of lies: lies, damned lies, and statistics.” It’s an amusing and quotable saying, with more than a little truth to it. In the mortgage industry, despite being a numbers-driven business, good, useable statistics can be tough to come by. When we do come across them, they carry a lot of credibility. Real, trustworthy data means a lot.

An ROI-driven industry

That’s especially true for mortgage lenders battling margin compression. Any unusual or strategic investments need to demonstrate some kind of ROI, or else their value may be suspect in the board room. It’s why lenders chafe at compliance costs. And it’s why, in part, it’s taken so long for the industry to truly embrace the value of good and effective technology.

We’re fortunate enough here at LodeStar to have access to a sizeable quantity of mortgage transactions through our closing cost calculator. So we tracked some numbers through 2021 to see what kind of cost savings our technology brought to its users. We expected good things. We received even better numbers than we expected…

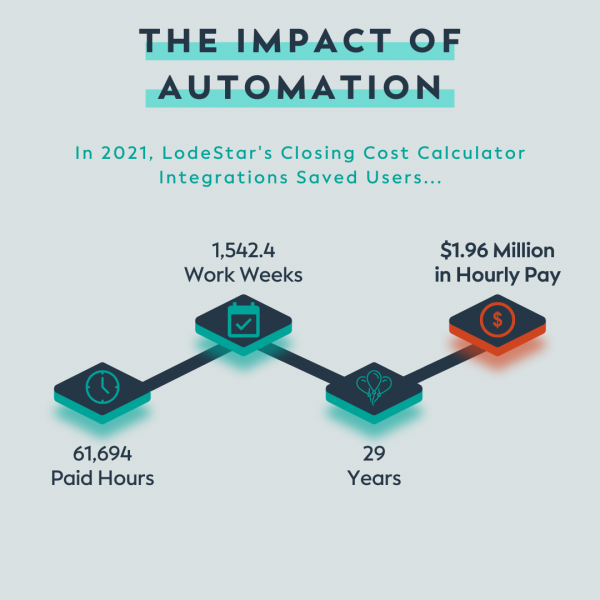

61,694 paid labor hours saved

Businesses using LodeStar’s cost calculator in 2021 saved 61,694 paid labor hours. (All calculations were based on formulas recommended by the U.S. Bureau of Labor Statistics, such as average hourly pay.) That’s time that would have otherwise been spent doing quick and dirty research on closing fees; reaching out to title companies or using primitive cost templates that may or may not be current, accurate or complete. 61,694 hours of time, to be precise. In other words, 1,542.4 traditional work weeks. 29 years. And that’s also $1,958,797.25 in hourly pay.

How’s that for ROI?

What to do with that saved time and expense

And lenders can certainly use those 61,694 hours of saved time. Especially in a competitive purchase market. If it’s the LO doing that closing fee research manually, perhaps with some of those 61,694 hours the LO could be digging deeper on a potential client’s true needs or determining the product that best fits that client’s profile. And when that loan doesn’t end up in the loan “fall-out” category because the client fits the loan, what’s the ROI on that?

Maybe some of those 61,694 hours of redirected time could be reinvested into marketing efforts. In a competitive purchase market, sales and marketing become critical. Maybe some of those efforts could go toward marketing to underserved or non-traditional markets—which could provide an edge despite the overall decline in origination volume expected this year. The ROI on that could be fairly easy to calculate.